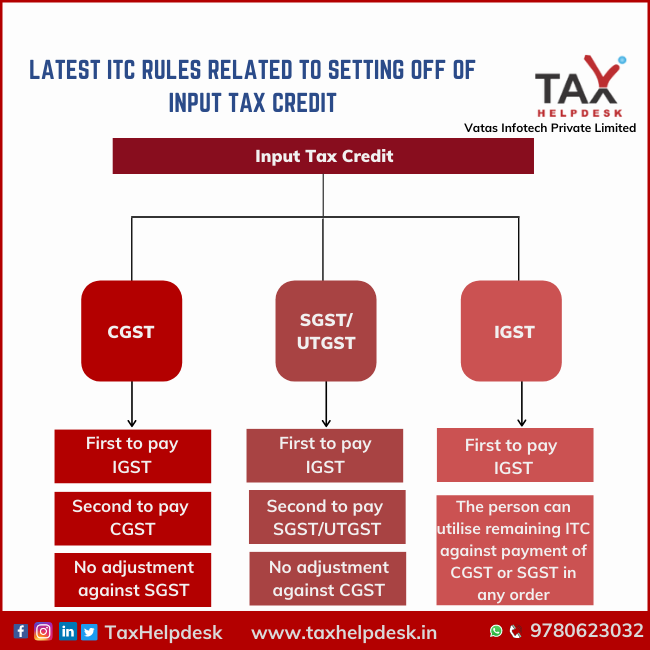

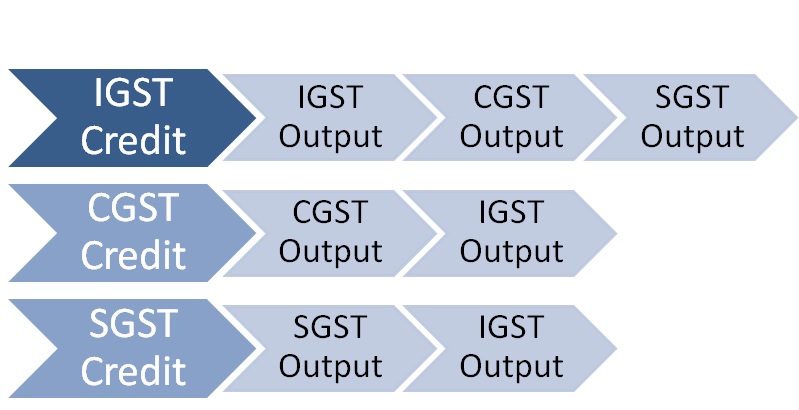

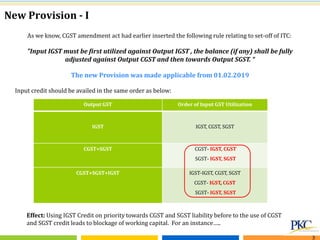

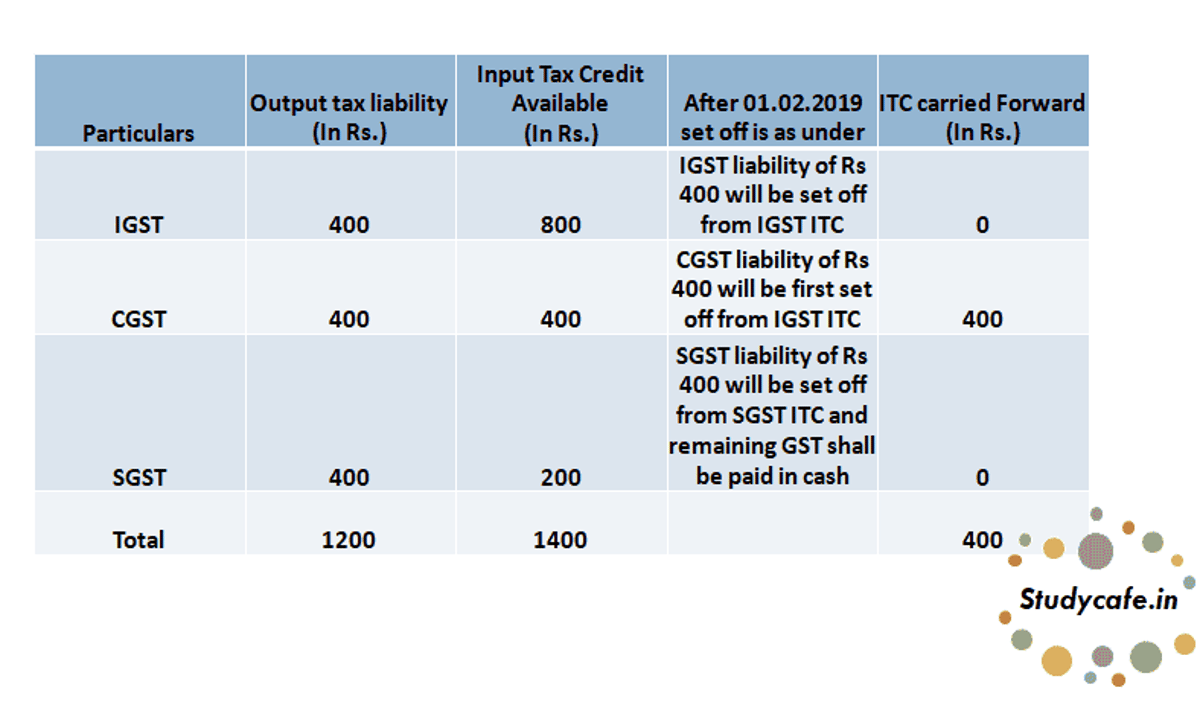

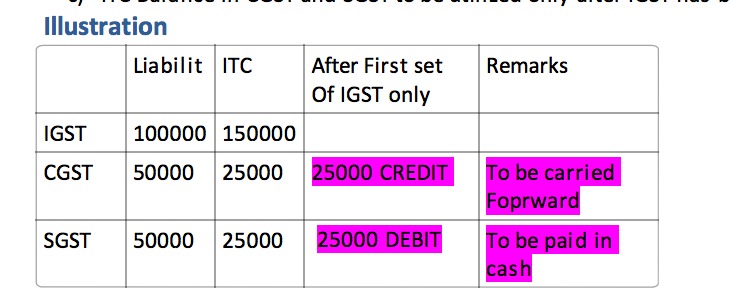

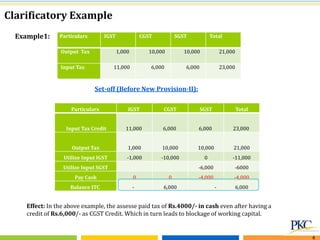

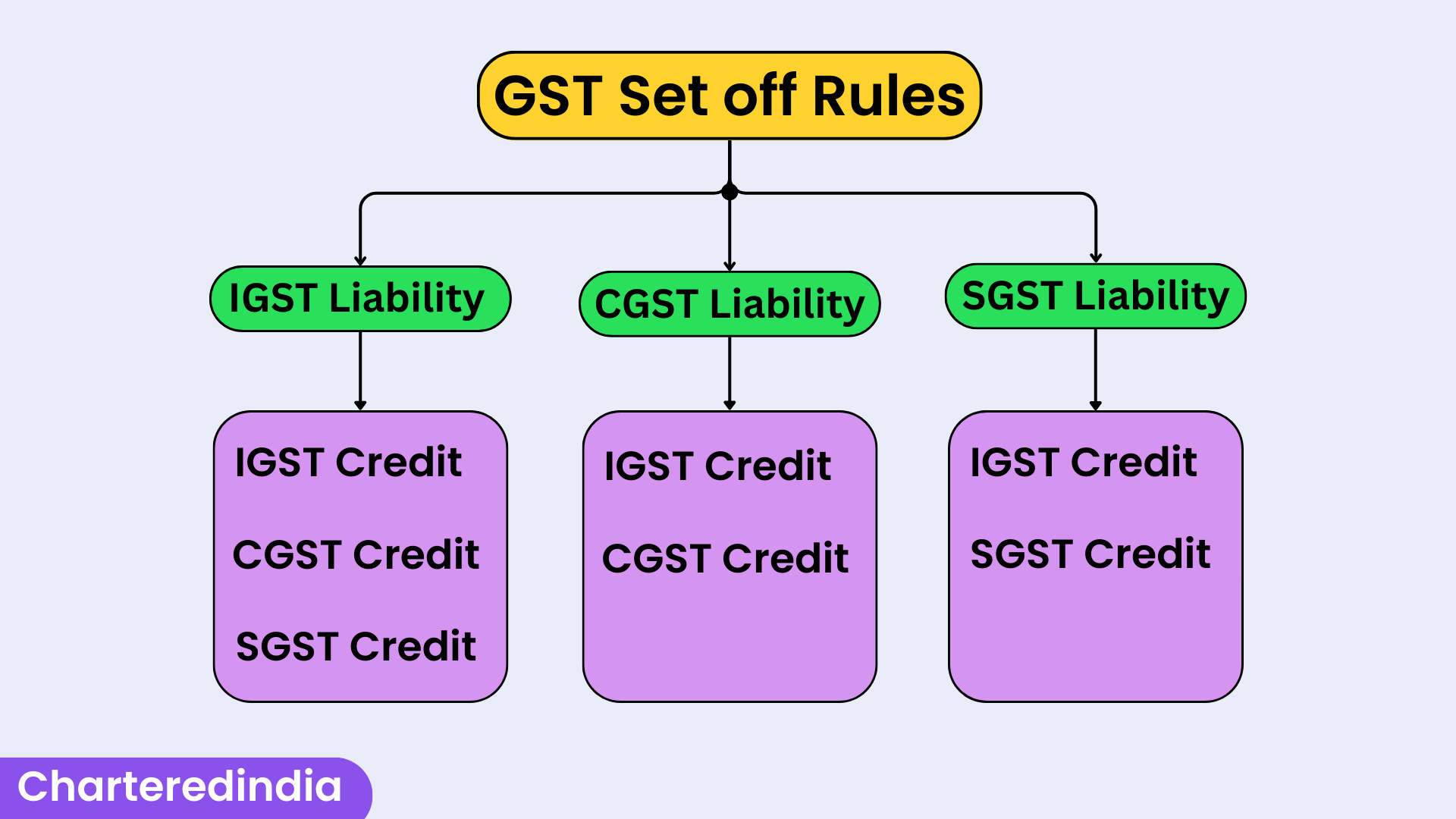

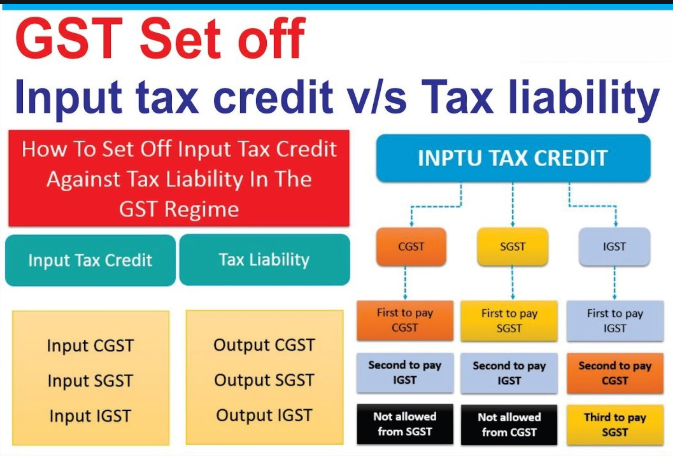

GST ITC SET OFF NEW RULES (LATEST)--GST ITC SET OFF नियम 01 फरबरी 2019 से बदल गए: GST ITC SETOFF NEW RULES IMPLECATED

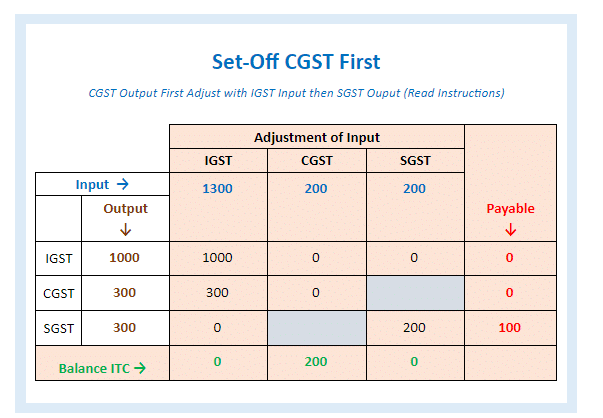

Goods and Service Tax (GST) Configuration (Tax Hierarchy and Set off Rules) in Microsoft Dynamics 365 Finance and Operations -Part-5 – Explore Microsoft Dynamics 365 Finance and Operations Together